Colorado Electric Vehicle Tax Credits

Updated as of 1/4/21: The $4,000 no longer applies for 2021. This credit has been reduced to $2,500.

Disclaimer: Drive Electric Colorado and its affiliates are not tax advisors. This information is provided to help you make an informed decision. Please consult your tax advisor for advice about your specific situation.

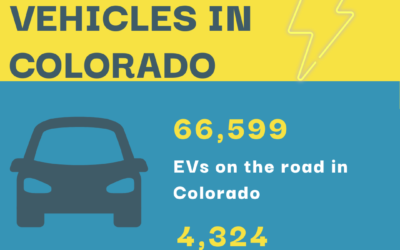

Interested in owning or leasing an electric vehicle? Right now you can get a $4,000 tax credit in Colorado for the purchase or lease of ANY new all-electric vehicle and qualifying plug-in hybrid electric vehicles! This includes all Tesla models and Bolts that do not receive the Federal tax incentive.

This tax credit goes down to $2,500 on January 1, 2021 so buy your car now to take advantage of the $4,000 credit.

You can lease an electric vehicle instead and get $2,500 by the end of the year. Tax credits can be stacked with federal EV incentives and will decrease in value after 2020, dropping to $2,500 in 2023 and $2,000 in 2026.

If you don't have $4,000 in Colorado state income tax this year you can roll over the unused portion of the credit to next year.

Don’t miss out on this offer to save big on electric vehicles by January 1, 2021.

Learn more about the Colorado tax credits and how to claim them here.

Check out other articles on this topic:

https://coloradosun.com/2020/03/09/evs-electric-vehicles-tax-incentives-refund-colorado-tesla-zev/